Buying my first ₿itcoin: A story to remember

Back in the summer of 2017, I was looking into investing some money, leaving it in the bank always gave me that "rat race" feeling. 🐀

I educated myself financially, but what really helped me was asking the right people the right questions. I knew who, in my close circle, was good with money and whom I could trust completely on that topic.

One trusted friend advised me to look into ₿itcoin, it has been performing like nothing else. Remember, this was the summer of 2017, and Bitcoin was averaging $2,500, a roughly 250% increase over the previous six months since January 2017.

So here I was, trying to make my first move in crypto.

- Where do I buy? Crypto exchanges were not yet mainstream.

- What do I trust? The reputation was poor.

- Where do I safely hold it for years after buying? Keeping it online was never an option.

I had to find a legitimate way, without resorting to any shady dark web operations.

I did my research and investigated available exchanges that allowed the legal purchase of Bitcoin. I took a deep dive into customer reviews to identify any red flags, avoiding platforms that seemed questionable.

Finally, I found one I could use: Cubits.com.

Cubits was founded in 2014 by Tim Rehder, Julian Mautner, and Andreas Lehrbaum. It launched in January 2015 after a year of development.

There was enough history, customer reviews, and proper KYC processes, including an in-person video call to open an account. It was centralized, sure, but I never intended to hide my Bitcoin purchase. I was ready to take action with a clear vision, keeping it simple in this brand new financial environment.

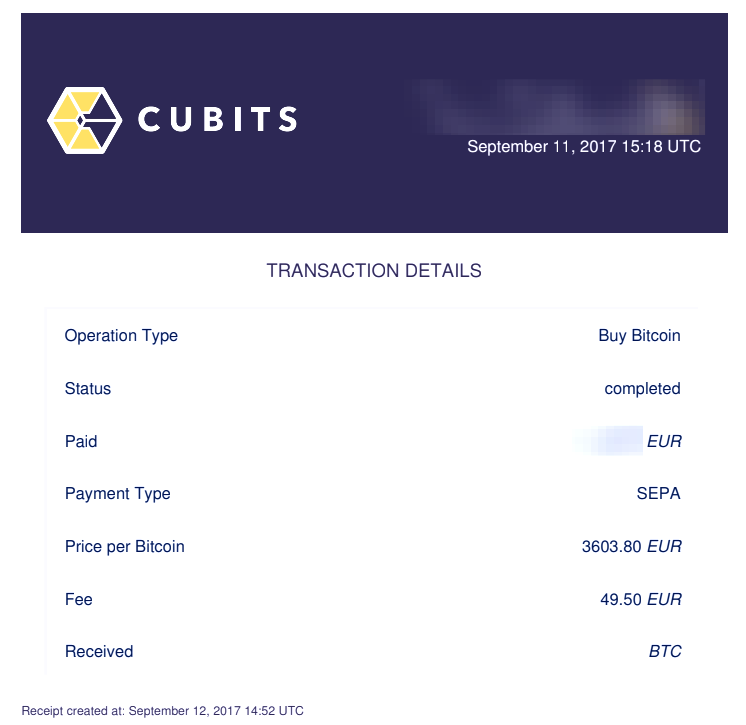

In September 2017, after two months of in-depth investigation, I was ready to make my first move.

I went for it

I didn't stop there. I knew that keeping my Bitcoin online in the exchange would be risky.

The most secure way to hold it for the long term was to own my keys. This meant owning the digital code (private keys) myself, rather than having them kept by another entity online, which would be at risk.

My next move was to transfer my recently acquired Bitcoin to a cold storage solution. In other words, this was my way of getting my Bitcoin offline, safe from anything beyond my control.

It also added an extra layer of responsibility: as the owner, no one is coming to save me if I make a mistake.

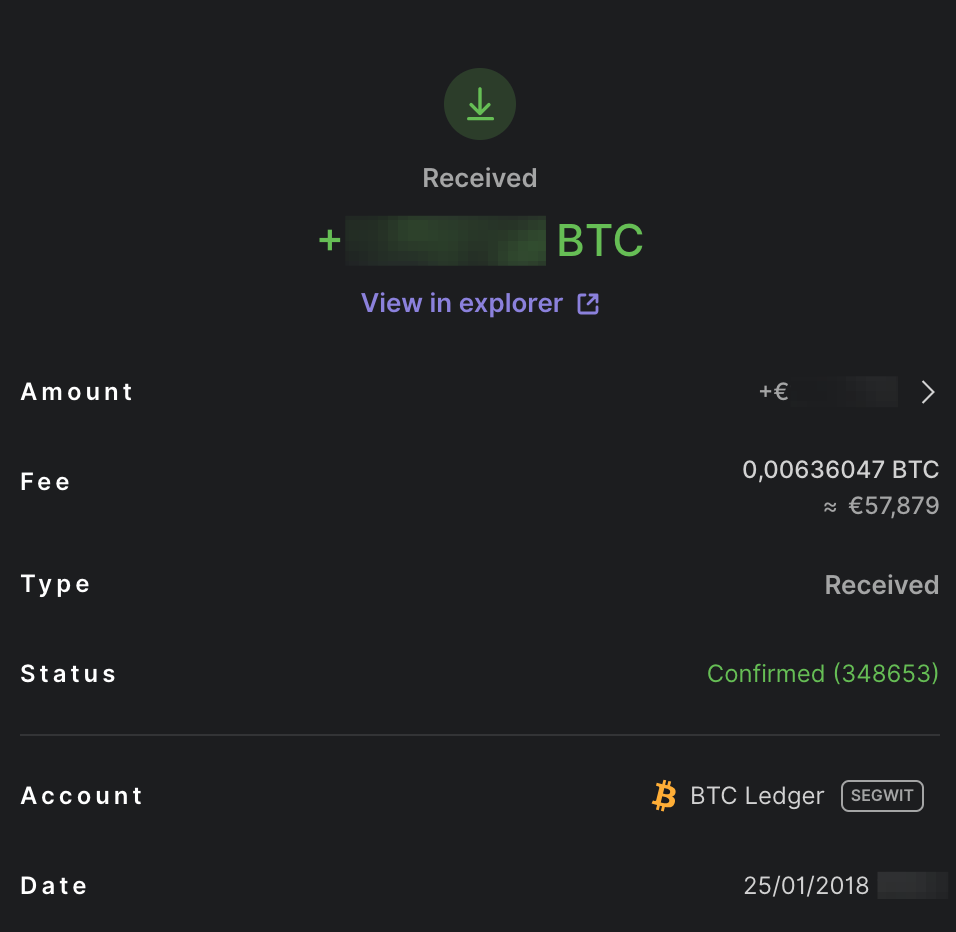

Beginning of 2018, I was considering Ledger or and Trezor for my cold storage solution. Ledger won my decision, so I took action and transferred what I owned.

The transaction in question was executed on January 25th, 2018, when the price of Bitcoin was averaging $10,000.

Little did I know that this would turn out to be an excellent decision; later that year, Cubits went into administration after being scammed by three of their own users.

Keeping it simple does not mean it's easy

It's having a plan, trusting your own ideas and executing it without fear that makes it easy